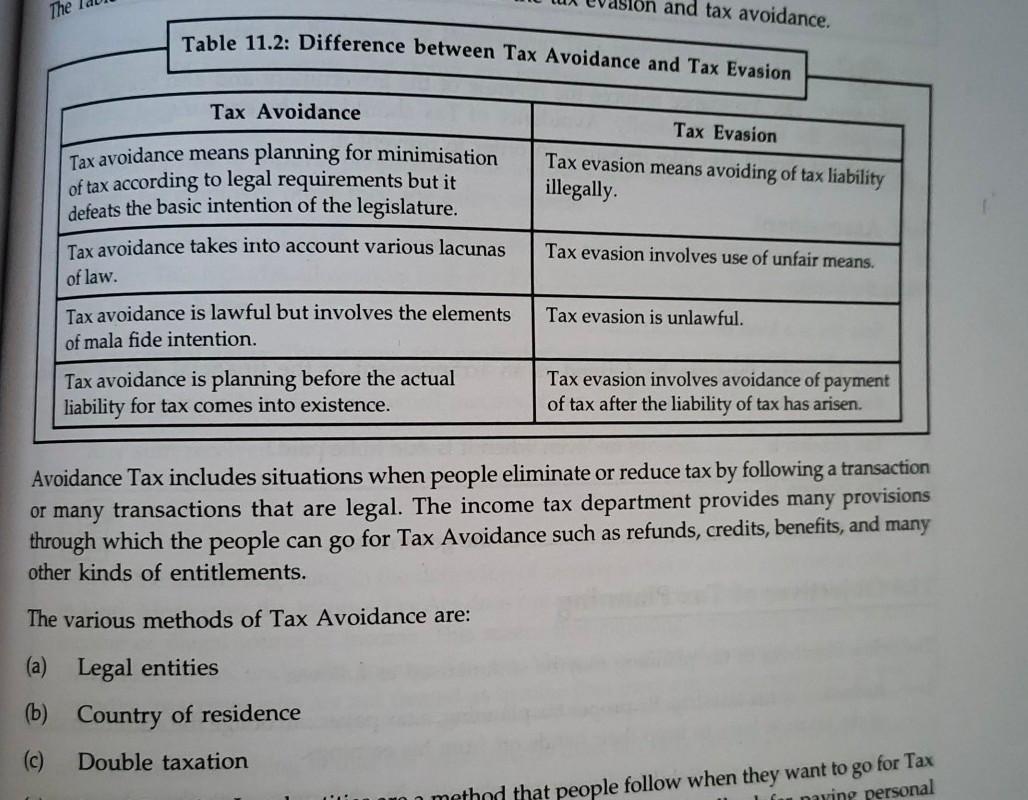

Explain the Difference Between Tax Avoidance and Tax Evasion

Imprisoned for up to five years. Tax evasion is illegal and objectionable.

Solved The And Tax Avoidance Table 11 2 Difference Between Chegg Com

In tax avoidance you structure your affairs to pay the least possible amount of tax due.

. But there are other more subtle cases where things are not so cut-and-dry. The difference between tax evasion and tax avoidance is an important one because tax evasion is criminal but tax avoidance is not. Tax planning and Tax avoidance is legal whereas Tax evasion is illegal.

Tax avoidance means legally reducing your taxable income. There are cases where the difference between these is clear. Moreover tax evaders may face other punishments that include.

This article helps elucidate the distinction. Forfeiture of tax returns and tax credits. While you get reduced taxes with tax avoidance tax evasion can result in fines penalties imprisonment or.

This might be underreporting income inflating deductions without proof hiding or not reporting cash transactions or hiding money in offshore accounts2 The Internal Revenue Code says that. Tax evasion on the other hand is using illegal means to avoid paying taxes. A taxpayer charged with tax evasion could be convicted of a felony and be.

There are many legitimate ways. This penalty can sometimes be up to 75 percent of the taxes owed along with the tax balance itself. Or both and be responsible for prosecution costs.

Underground economy Money-making activities that people dont report to the government. I suppose all of us would like to avoid paying taxes - certainly paying more than we have to. In tax evasion you hide or lie about your income and assets altogether.

Both tax planning and tax avoidance are legal. Usually tax evasion involves hiding or misrepresenting income. Tax evasion is when you use illegal practices to avoid paying tax.

There is no crime in trying to avoid taxes. Features and differences between Tax evasion Tax avoidance and Tax Planning. There are a number of penalties that authorities could apply such as a failure to file penalty or an underpayment penalty.

Tax evasion is a crime a felony unlike tax avoidance. If youve gone a step further and are deemed to be engaging in aggressive tax avoidance that HMRC doesnt agree with you could be investigated and potentially pay the tax back but it is a murky area at times. Tax planning is moral.

While assessee can get punishment which may not be bailable for tax evasion Tax Evasion Tax Evasion is an illegal act. There is a very thin line difference between tax evasion and tax avoidance thus the taxpayer has to be very diligent and careful while tax planning so that he does not go too far from the legal line of tax avoidance. However if the IRS finds that you owe more than you thought was fair they could charge you the.

The main difference between tax evasion and tax avoidance lies in that tax evasion is illegal whereas tax avoidance is a legal method used to reduce tax payments that at times can be unethical in nature. Tax evasion is considered a crime. Tax avoidance is performed by availing loopholes in the law but complying with law provisions.

Tax evasion means concealing income or information from tax authorities and its illegal. Tax avoidance and tax evasion are both mechanisms used in order to avoid or reduce the amount paid as taxes. The difference between tax avoidance and tax evasion boils down to the element of concealing.

Tax avoidanceAn action taken to lessen tax liability and maximize after-tax income. For example Alex works at an accounting firm and wants to minimize his tax bill he claims 700 in deductions for fictitious meals and entertainment moreover he neglects to report 7000 he. But its not quite as simple as that.

Seizure of assets like cars houses and jewelry. Unlike tax avoidance tax evasion has criminal consequences and the individual may face prosecution in criminal court. Tax evasion The failure to pay or a deliberate underpayment of taxes.

Deliberate Omission or under-reporting of Tax Liability. With this they end up not paying the IRS what they should. The basic difference is that avoidance is legal and evasion is not.

Tax avoidance is immoral. By contrast tax evasion means employing illegitimate means for nonpayment of tax. Bank liens or seizure of their bank accounts.

Key Differences The primary key difference tax planning is within the four pillars of the law and if a person is saving the tax by. Answer 1 of 12. Fined up to 100000 or 500000 for a corporation.

This is when people deliberately do not file their returns. The Tax avoidance is not performed through sinister intentions but by lawfully complying with the provision of law but in Tax Evasion is further performed through the unlawful and an illegal way of paying taxes and the nonpayer shall get punished. As considered as fraud tax evasion is an illegal method to reduce tax.

Businesses and sole traders can avoid tax by claiming expenses to reduce their tax bill. Tax avoidance is defined as legal measures to use the tax regime to find ways to pay the.

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Difference Between Tax Avoidance And Tax Evasion

Tax Evasion Vs Tax Avoidance Top 4 Differences Infographics

Differences Between Tax Evasion Tax Avoidance And Tax Planning

No comments for "Explain the Difference Between Tax Avoidance and Tax Evasion"

Post a Comment